Cornerstone at Rockridge – Real Estate Finance Final

Project Overview

This was a final project and presentation for my Real Estate Finance class. We recorded a pitch video and presented it on the day of our finals. Cornerstone at Rockridge demonstrates some of the most challenging work I've done in Excel—layered equations made the proforma as soft-coded as possible (that means we designed it so variables could easily be adjusted without breaking formulas). We were assigned a parcel and competed against our classmates to create the most profitable solution for the site. The project sharpened my Excel modeling skills and gave valuable practice in researching zoning, city requirements, and financial assumptions.

Project Details

Executive Summary

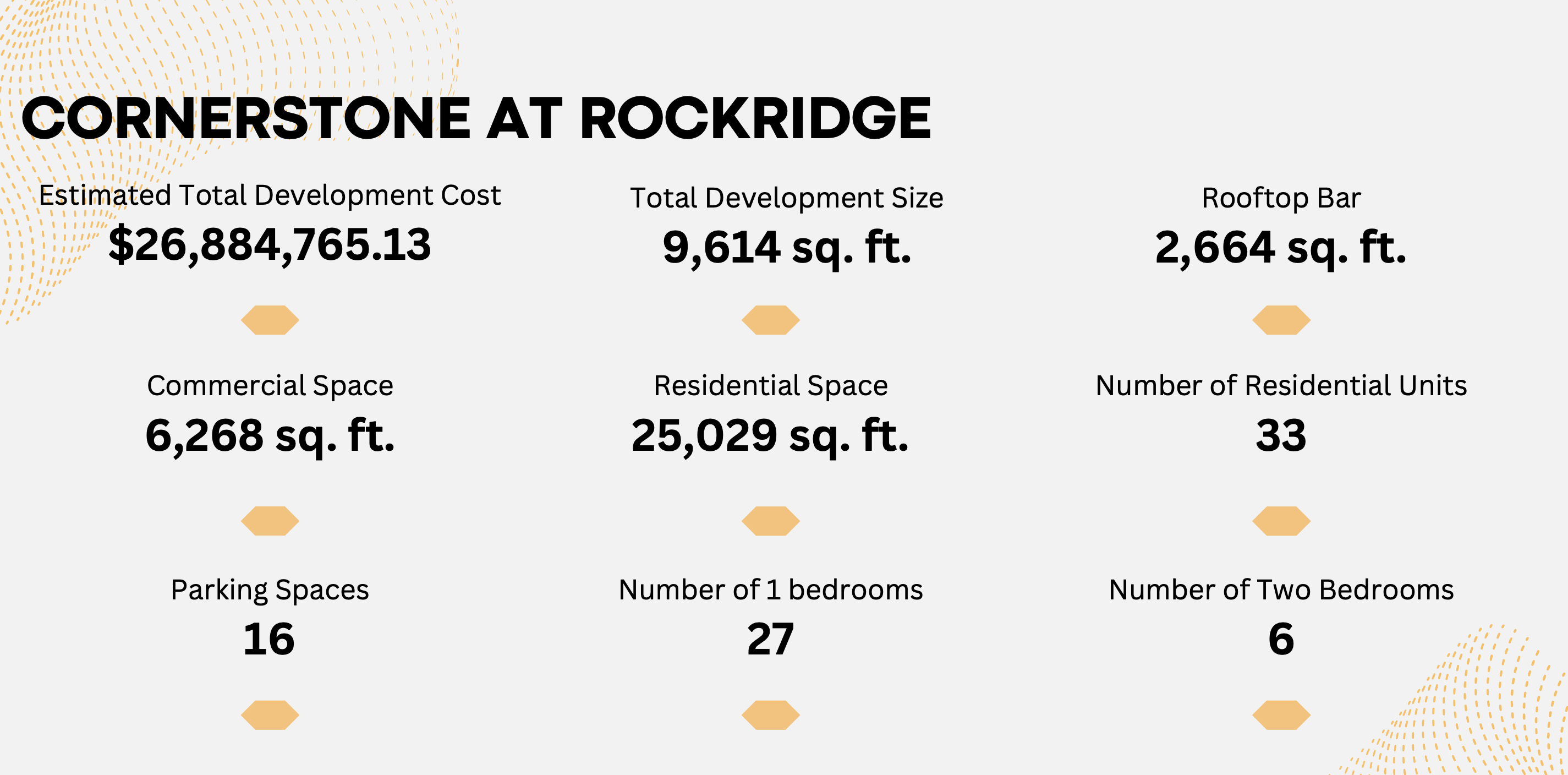

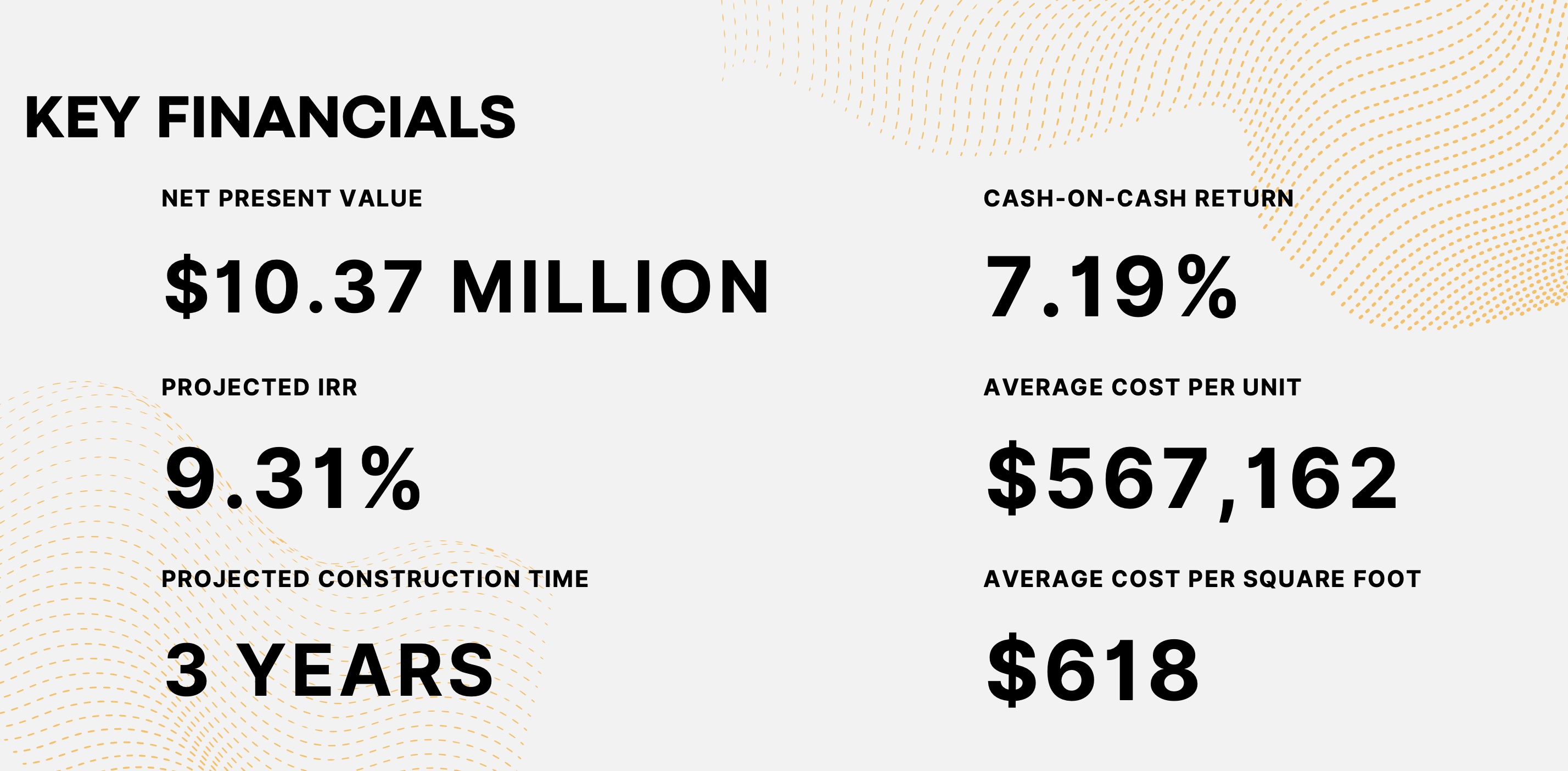

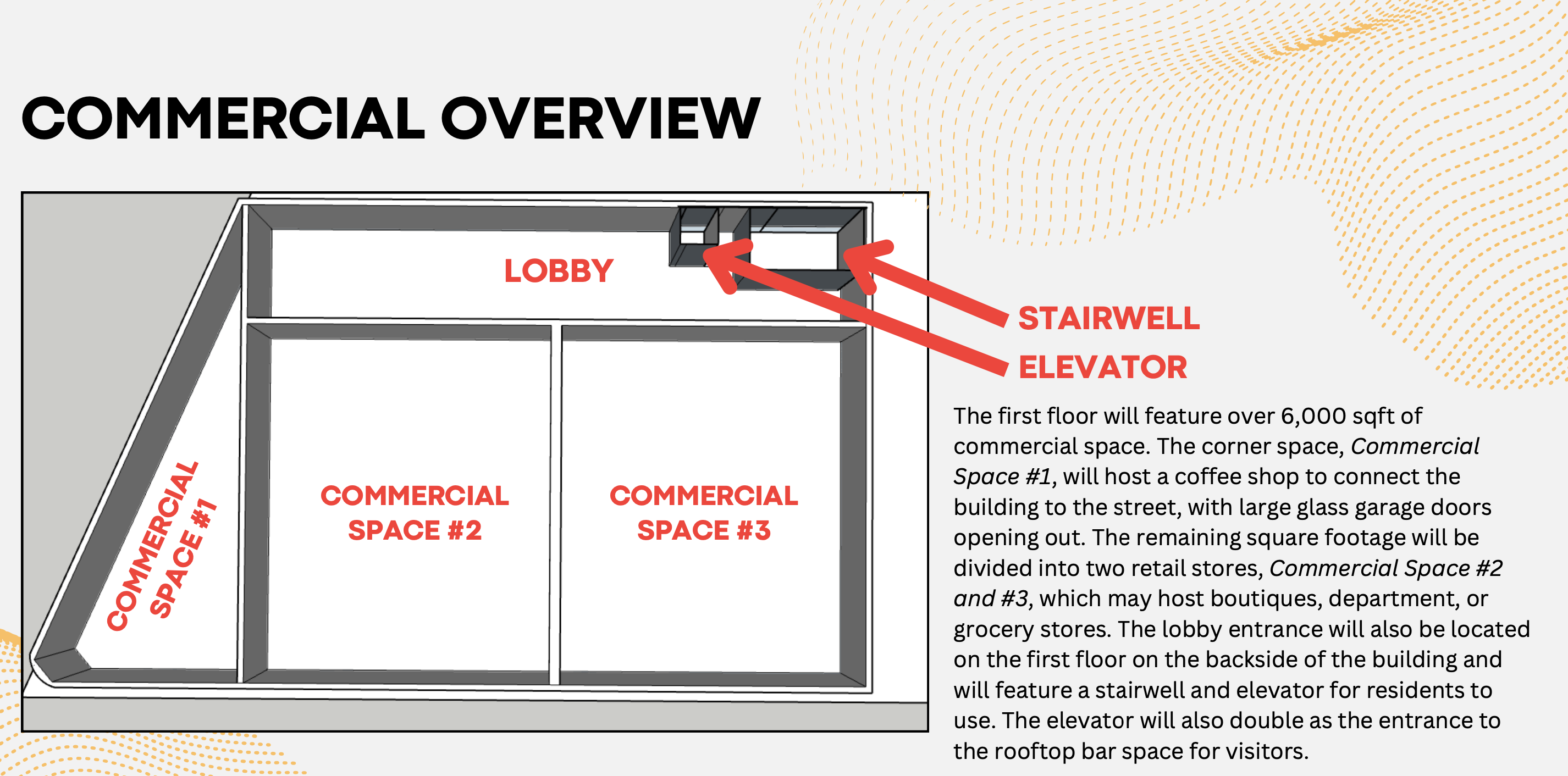

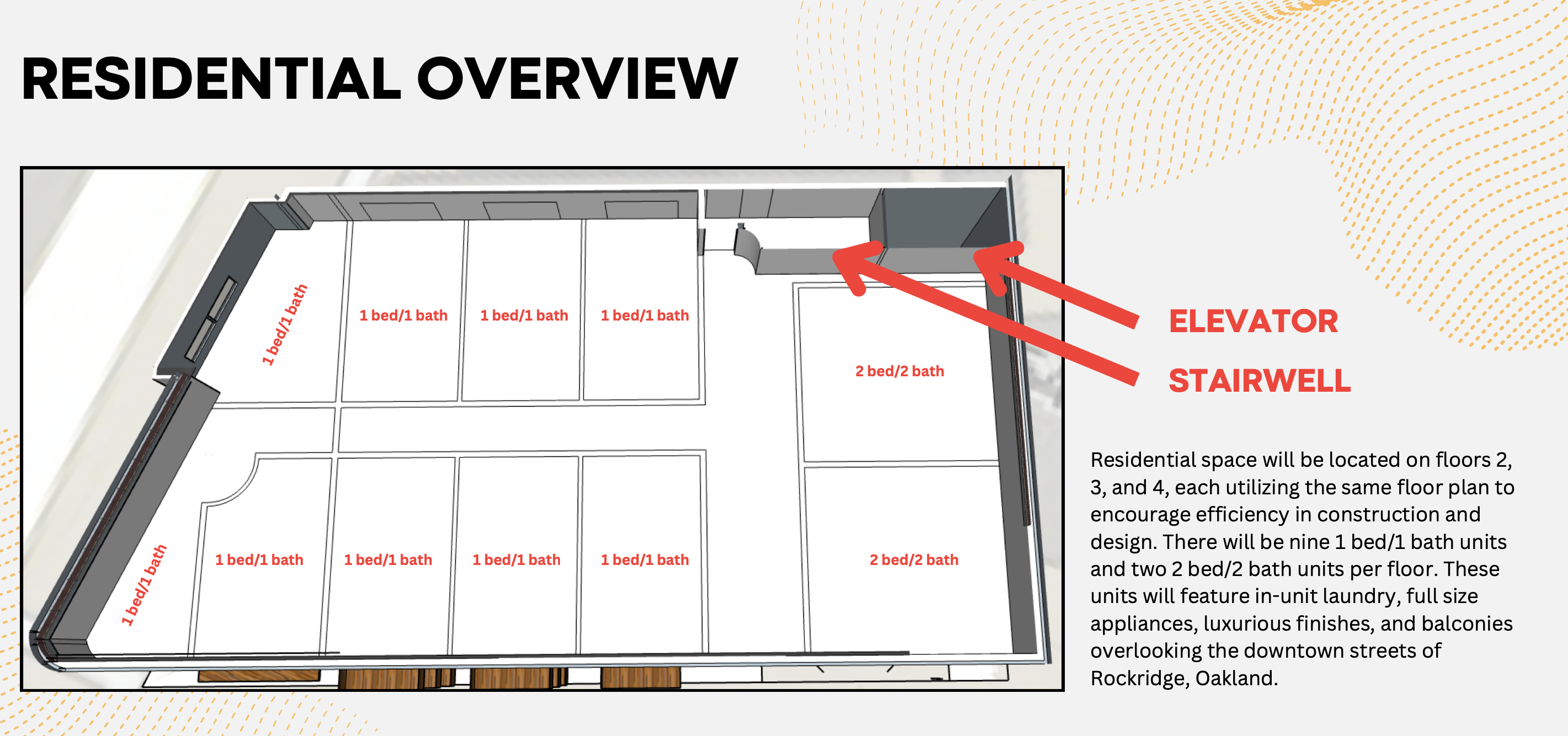

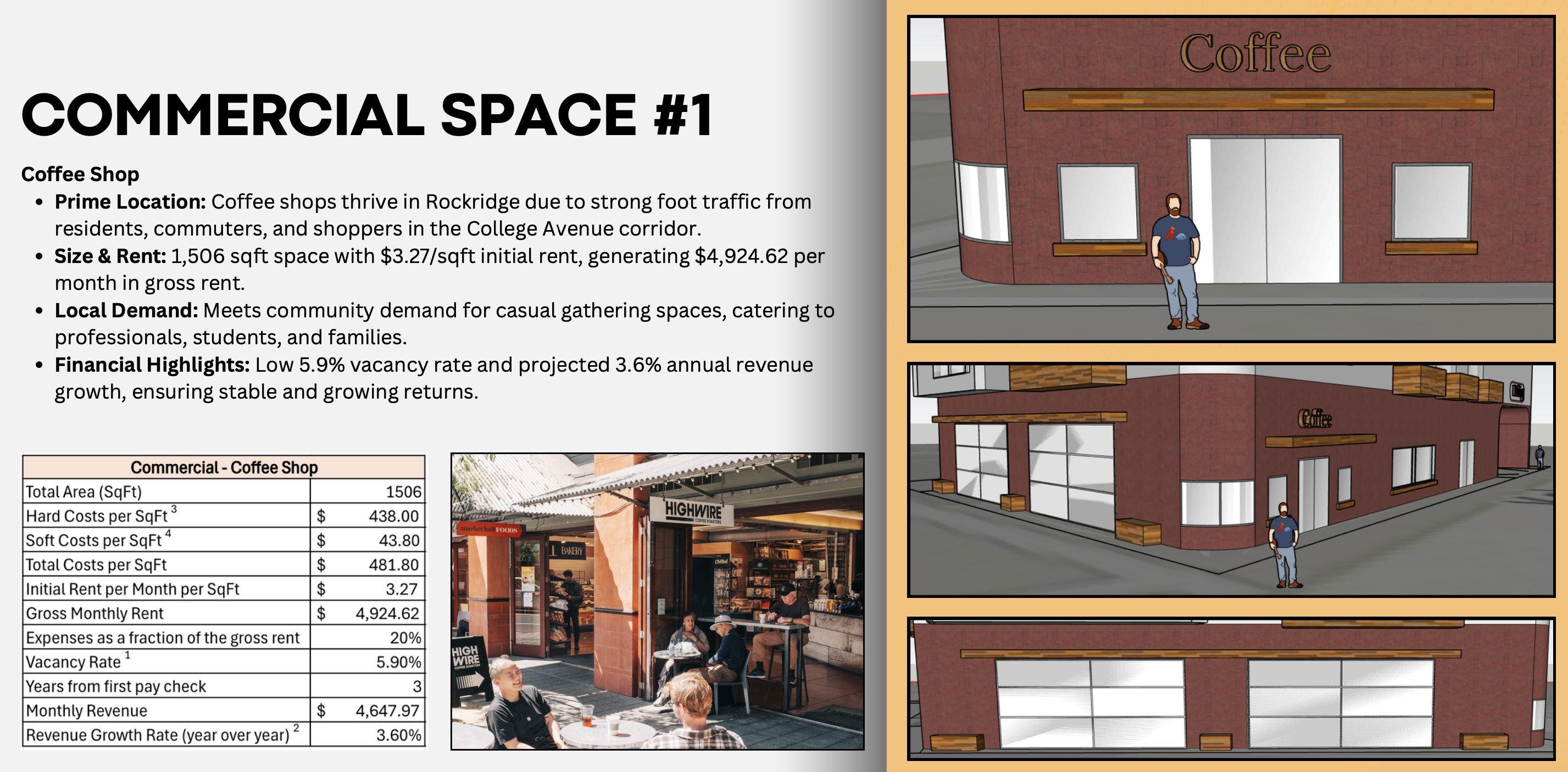

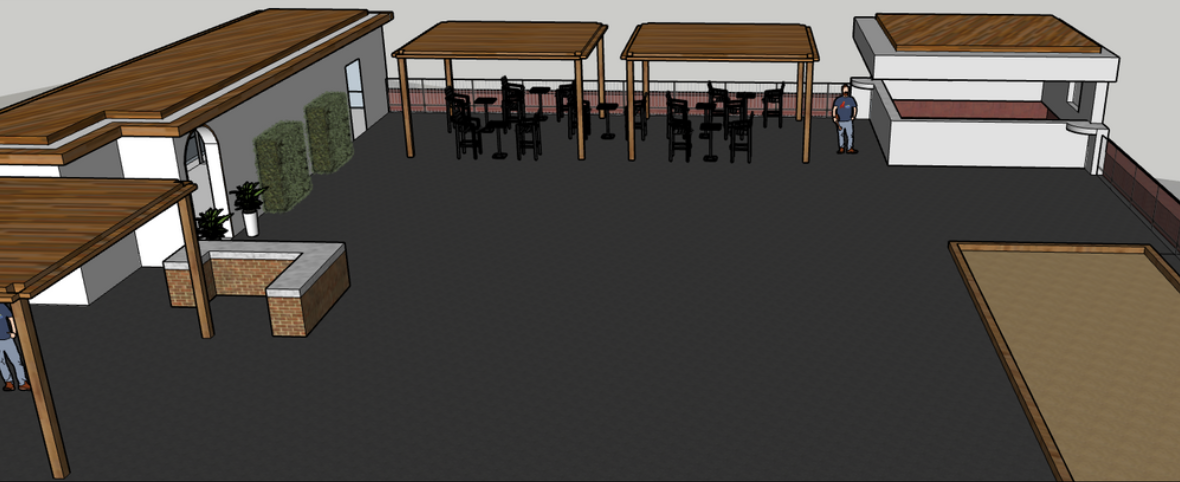

Cornerstone at Rockridge is a mixed-use development located in the heart of Oakland’s Rockridge neighborhood. The project includes three ground-floor commercial spaces (including a coffee shop and boutique retail), 33 residential units across three floors, and a rooftop bar designed to maximize revenue and community engagement. With a strong emphasis on walkability, tenant desirability, and market-driven financials, the project balances lifestyle design with robust returns. Despite a modest site footprint, efficient planning yielded over 34,000 square feet of usable space with an IRR of 9.31% and a projected NPV of $10.37 million.

Key Project Stats

- Total Units: 33 (27 one-bedrooms, 6 two-bedrooms)

- Development Size: 34,911 sq. ft.

- Residential Area: 25,029 sq. ft.

- Commercial Space: 6,268 sq. ft.

- Rooftop Bar: 2,664 sq. ft.

- Estimated Development Cost: $26,884,765.13

- NPV: $10.37 million | IRR: 9.31% | CoC Return: 7.19%

- Cost Per Unit: $567,162 | Cost Per SF: $618

- Construction Timeline: 3 years

Key Technologies & Skills

- Excel: Designed a multi-layered, soft-coded proforma with dynamic assumptions

- Market Analysis: Researched Rockridge neighborhood comps, demand, and tenant mix

- Financial Modeling: Created rent rolls, ROI metrics, cap rate-based exit values, and IRR projections

- Urban Development: Navigated zoning rules (FAR, setbacks, height limits, and landscaping)

- Team Collaboration: Presented final proposal via video pitch and offering memo